Yekani Private Wealth Management & Real Estate

Home of Financial X-Ray

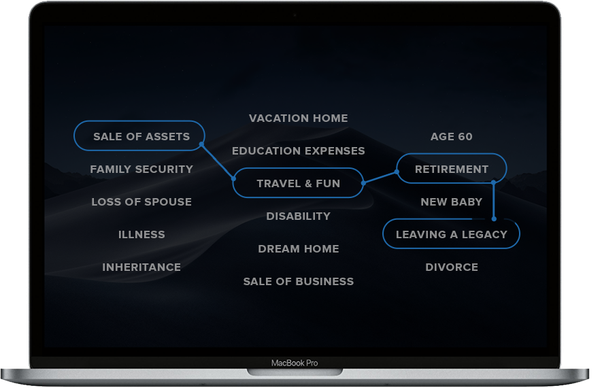

Our Financial X-Ray process has helped guide many families and business owners into making fewer financial mistakes, allowing them to keep more of what they earn and build a stronger family legacy.

Financial Planning Doesn't Need to be Complicated

It is our job to fully understand your financial situation and retirement goals. We work with you to identify any critical mistakes or gaps in your financial plans to help create a plan custom to you. By offering a wide range of financial services and retirement planning assistance, we help our clients achieve the retirement of their dreams.

Our Step-by-Step Process for Financial Success

We identify your critical financial mistakes.

How many critical financial mistakes have you made in the past? How much did they cost you? We answer these two questions in our first step.

We show you a map of your future.

We create a customized plan, eliminating costly financial mistakes and show you a roadmap to your financial future.

We guide you to execute for success.

We guide you to take the right action steps and become confident in making the right financial decisions for yourself and your family.

Tune In To Radio Hamrah

For more than 15 years, the Yekani Wealth Management & Real Estate Radio program has provided financial information to the Persian community throughout the greater Los Angeles and Orange County area.

As Heard On:

“We’ve found a new

financial freedom with Yekani Wealth Management & Real Estate. Nick and his team have made a huge impact on our lives.”

Tom Serrano

Contact Us Today

Please fill out the form below to get in touch with us.

Fields marked with an * are required

Contact Us - Short Form

We will get back to you as soon as possible.

Please try again later.

Woodland Hills

6300 Canoga Ave. Suite 1100

Woodland Hills, CA 91367

Phone: 800-220-9609

Fax: 866-681-8864

Westwood

Oppenheimer Tower

10880 Wilshire Blvd. Ste 1101

Westwood, CA 90024

Phone: 800-220-9609

Fax: 866-681-8864

We are an independent financial services firm helping individuals create retirement strategies using a variety of insurance products to custom suit their needs and objectives. Nick Yekani | CA Insurance # 0635825 Firm License # 0K36793

None of the information contained on this website shall constitute an offer to sell or solicit any offer to buy a security or any insurance product.

Any references to protection benefits or steady and reliable income streams on this website refer only to fixed insurance products. They do not refer, in any way, to securities or investment advisory products. Guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company. products may be subject to fees, surrender charges and holding periods which vary by insurance company.

The information and opinions contained in any of the material requested from this website are provided by third parties and have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. They are given for informational purposes only and are not a solicitation to buy or sell any of the products mentioned. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation.